Les actualités de la BRVM en Flux RSS

Les actualités de la BRVM en Flux RSS

Nous agrégeons les sources d’informations financières spécifiques Régionales et Internationales. Info Générale, Economique, Marchés Forex-Comodities- Actions-Obligataires-Taux, Vieille règlementaire etc.

Enjoy a simplified experience

Find all the economic and financial information on our Orishas Direct application to download on Play StoreTOPICS COVERED IN THIS MARKET BRIEFING:

EUROPEAN STOCK MARKETS REMAIN OPTIMISTIC

European stock markets rose slightly on Thursday pending the presentation of the future American recovery plan for president-elect Joe Biden.

The market trend remains dictated by American news with Joe Biden's presentation on Thursday of an ambitious recovery plan that should reach around 2,000 billion dollars and include sending checks to households and financing to states and local authorities.

While the United States is preparing to boost fiscal support in the face of the impact of the health crisis, investors are wondering if at the same time the Federal Reserve is not considering reducing the ban on asset purchases.

In this context, the market will carefully follow the words of Jerome Powell, the chairman of the Fed. The session will be animated, among other things, by unemployment registrations in the United States, and the publication of the report of the last monetary policy meeting of the European Central Bank.

WALL STREET WEAKENED BY IMPEACHMENT PROCEEDINGS

Wall Street ended in fragmented order on Wednesday, with investors preferring to adopt a wait-and-see attitude as debates concerning the “impeachment” procedure against US President Donald Trump

A week after Donald Trump supporters stormed the Capitol, the American House of Representatives approved his impeachment on Wednesday for “inciting insurgency,” during a speech delivered before the violence.

Some investors fear that an “impeachment” procedure will delay the implementation of the recovery plan planned to alleviate the effects of the coronavirus pandemic.

The markets are also waiting for the earnings season to kick off, which will be given by several major banks on Friday and will test the high valuations achieved by equities.

As aresult, the Dow Jones lost 0.03% to 31,060.47 points. The Nasdaq rose 0.43% and the S&P-500 advanced

0.23%.Other financial market news

On the foreign exchange market, the dollar is unchanged against a basket of reference currencies and the euro is trading at around 1.216

Oil prices rose slightly thanks to the decrease in American crude stocks for a fifth consecutive week and the record level of crude imports into China in 2020, but the rise in COVID cases worldwide is limiting gains.

According to figures from the U.S. Energy Information Agency, stocks fell by 3.2 million barrels last week in the United States compared to a fall of 2.3 million barrels expected by the Reuters consensus.

Today's economic calendar:

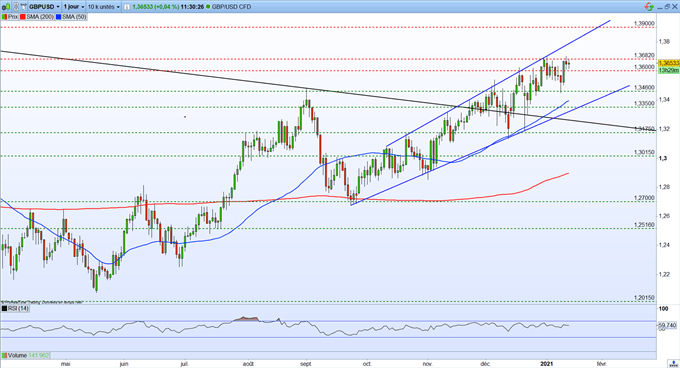

CHART OF THE DAY —GBP/USD: AN UPWARD EXPANSION

The pound sterling is rising against the US dollar and prices are evolving within an upward expansion. For the moment, the momentum remains bullish, the market is working a resistance at $1.3680, so the break should lead to a further acceleration to reach the next level at $1.3900

.The current outlook is favourable for the trend to continue in the coming days. A retracement of the support level to $1.3460 is possible, however we believe that GBP/USD has the capacity to set new highs

.

Vous devez être membre pour ajouter un commentaire.

Vous êtes déjà membre ?

Connectez-vous

Pas encore membre ?

Devenez membre gratuitement

15/12/2022 - Economie/Forex Indice/Marchés

22/04/2022 - Economie/Forex

22/04/2022 - Economie/Forex

21/04/2022 - Economie/Forex

21/04/2022 - Economie/Forex

21/04/2022 - Economie/Forex

20/04/2022 - Economie/Forex

20/04/2022 - Economie/Forex

![[Orishas-finance] : ORISHAS FUNDS360 - Les données du marché africain s'offrent à vous](/uploads/news/859fd87b75b5b18da5e7104b992d6394.jpg)

15/12/2022 - Economie/Forex Indice/Marchés

22/04/2022 - Economie/Forex

22/04/2022 - Economie/Forex