Les actualités de la BRVM en Flux RSS

Les actualités de la BRVM en Flux RSS

Nous agrégeons les sources d’informations financières spécifiques Régionales et Internationales. Info Générale, Economique, Marchés Forex-Comodities- Actions-Obligataires-Taux, Vieille règlementaire etc.

Enjoy a simplified experience

Find all the economic and financial information on our Orishas Direct application to download on Play StoreEuropean stock markets rose on Thursday, driven by announcements from the Federal Reserve, which pleaded, as expected, for continued support for the American economy and by hopes of an agreement on a fiscal stimulus package in the United States.

European stocks are taking advantage of the promise made by the Fed on Wednesday evening to continue injecting liquidity into the economy and financial markets to combat the risk of recession, even if its leaders are a bit more optimistic for next year thanks to the deployment of the first authorized coronavirus vaccine.

Investors are keeping an eye on Congress, where negotiations between elected officials are progressing on a $900 billion stimulus package that could include $600 to 700 in direct assistance to individuals as well as an extension of federal unemployment benefits, several sources said Wednesday.

On the health front, the French Prime Minister said on Wednesday that the first vaccinations against COVID-19 could begin in the very last days of the year if the European calendar for approving vaccine candidates was respected.

Wall Street ended down 0.15% on Wednesday while Nasdaq finished high as investors welcomed the Fed's promise to continue supporting the economy.

The US Federal Reserve left monetary policy unchanged on Wednesday but promised to continue supporting the economy and markets, even if its leaders are a bit more optimistic about next year.

The US central bank reiterated its commitment to maintaining a virtually zero federal funds rate target until the economic recovery was complete, but added that its market purchases of securities were now also linked to this objective.

Investors will have waited throughout the congressional news session when an agreement on stimulus measures for American households was being drafted.

As a result, the Dow Jones lost 0.15% to 30,154.54 points. The Nasdaq rose 0.50% and the S&P-500 advanced

0.18%.Other financial market news

The euro has reached a peak since April 2018 with the fall of the dollar caused by the Fed's announcements and the confidence of currency traders in the ability of American elected officials to agree on a support plan.

Boosted by signs of progress in the Brexit discussions, the pound sterling advanced by 0.56% against the dollar, rising to a high since May 2018.

The oil market is rising after the Energy Information Administration announced a sharper-than-expected drop in U.S. crude inventories and thanks to optimism about the coronavirus vaccination campaign in the United States.

Today's economic calendar:

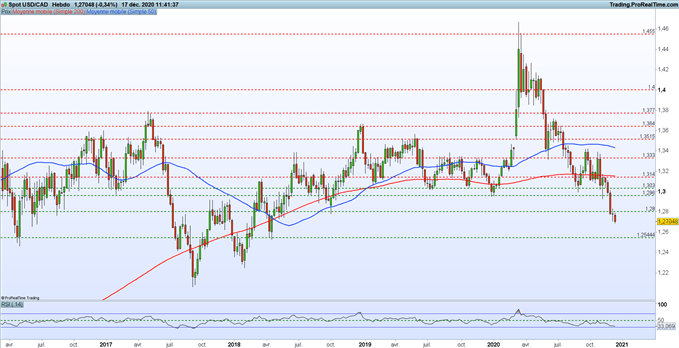

The US dollar has been widening its losses against the Canadian dollar for several weeks. The Fed's announcements did not allow the greenback to rebound. On the other hand, the rise in oil is strengthening the Canadian dollar.

It is difficult to see a technical rebound in this current context, sellers are keeping their hands on by pushing the supports. The momentum is strongly bearish, so we will monitor the 1.2545 level to stabilize prices

.This threshold should allow the pair to regain some height. However, as long as the market does not succeed in regaining the 1.2960 to reverse the trend, traders will seek to position themselves in a downward direction

.Learn more about financial market news by consulting my previous Market Briefing.

Vous devez être membre pour ajouter un commentaire.

Vous êtes déjà membre ?

Connectez-vous

Pas encore membre ?

Devenez membre gratuitement

17/12/2022 - Indice/Marchés

15/12/2022 - Economie/Forex Indice/Marchés

22/04/2022 - Indice/Marchés

22/04/2022 - Indice/Marchés

21/04/2022 - Indice/Marchés

20/04/2022 - Indice/Marchés

19/04/2022 - Indice/Marchés

15/04/2022 - Indice/Marchés

15/04/2022 - Indice/Marchés

17/12/2022 - Indice/Marchés

![[Orishas-finance] : ORISHAS FUNDS360 - Les données du marché africain s'offrent à vous](/uploads/news/859fd87b75b5b18da5e7104b992d6394.jpg)

15/12/2022 - Economie/Forex Indice/Marchés

22/04/2022 - Indice/Marchés