Les actualités de la BRVM en Flux RSS

Les actualités de la BRVM en Flux RSS

Nous agrégeons les sources d’informations financières spécifiques Régionales et Internationales. Info Générale, Economique, Marchés Forex-Comodities- Actions-Obligataires-Taux, Vieille règlementaire etc.

Enjoy a simplified experience

Find all the economic and financial information on our Orishas Direct application to download on Play StoreTOPICS COVERED IN THIS MARKET BRIEFING

European stock markets ended sharply lower on Thursday, caught up in concerns about the strength of the economic recovery after disappointing U.S. economic indicators.The European stock markets ended sharply lower on Thursday, caught up in concerns about the strength of the economic recovery after disappointing U.S. economic indicators and the day after the Federal Reserve released its "minutes", the tone of which surprised investors with its caution.

The decline was marked at the opening of the day following the publication of the minutes of the last Fed meeting, from which investors have mainly retained the concern expressed by several leaders of the U.S. central bank about the fragility of the economic recovery. And the day's news from the United States only accentuated the downward trend.

Thus, the CAC 40 index lost 1.33% to 4,911.24 points. The Footsie dropped 1.55% and the DAX 30 fell 1.14%.

WALL STREET ENDS HIGHER DESPITE UNEMPLOYMENT NUMBERS

Wall Street finished in the green on Thursday, with a record closing for the Nasdaq, the rise in technology stocks prevailing over disappointing indicators, confirming the Federal Reserve's cautious view on economic recovery.

The indicators of the day were in half-tone with in particular a rebound of the weekly unemployment registrations last week in the United States, which went back above the million mark.

In total, 14.8 million people received unemployment benefits during the week of August 2-8, with the data being published with a week's delay.

Manufacturing activity in the Philadelphia region of the northeastern United States continued to grow in August, but at a slower pace than in June and July, according to a Fed index.

The Conference Board's index of leading indicators also remained up in July for the third consecutive month, by 1.4%, but also at a slower pace than in May (3.1%) and June (3%).

As a result, the Dow Jones, took 0.17% to 27,692.88 points. The Nasdaq fell by 1.06% and the S&P-500 gained 0.32%.

Interested in the indices? Find out our forecast for the next 2 months by clicking here

Other financial market news

FOREX

The dollar is consolidating its sharp rebound from Wednesday's minutes of the Federal Reserve's latest meeting against other major currencies.

The index measuring changes in the U.S. currency against a basket of benchmarks rose 0.08% after a 0.67% gain the previous day, one of its best daily performances in recent months.

Oil

The oil market did not escape the general gloom, especially since according to information from Reuters, some producer countries of the informal group "Opep+" have produced too much in the period May-July, which forces them, in theory at least, to reduce their pumping in August and September.

Brent crude gave up 1.43% to $44.72 a barrel and WTI light crude 1.12% to $42.45.

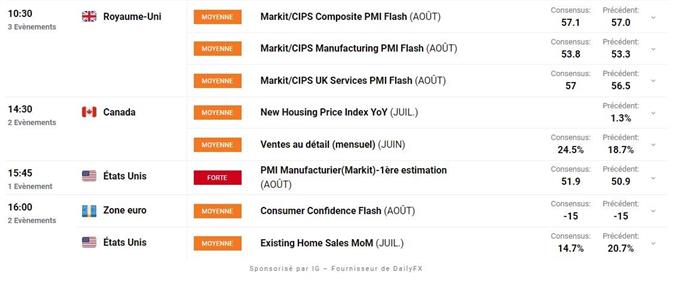

Today's economic calendar:

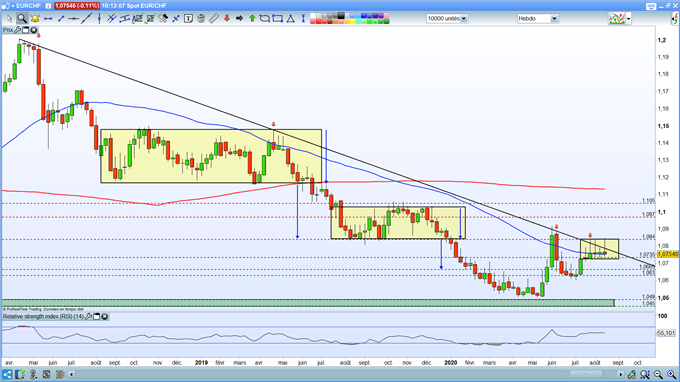

CHART OF THE DAY - EUR/CHF: A CONSOLIDATION RANGE

For several weeks now, the EUR/CHF has been moving without direction and has not been able to break through the famous 1.0840 resistance level. For now, we are witnessing a consolidation range between 1.0840 and 1.0735. Thus, only the break of one of the two bounds will allow to set the tempo for the continuation, in order to position itself to accompany the Momentum to come.

However, on this weekly chart, the long-term bearish oblique continues to put pressure on buyers. Indeed, as long as the latter is not broken at the weekly close, the bullish restart looks complicated for the pair. In addition, prices will have to break through the 1.0840 resistance to regain height towards 1.0970 and then 1.1050.

Finally, assuming that sellers keep the hand and push the nail under the support of 1.0735, then the risk of a fall towards 1.0630 would not be excluded.

Vous devez être membre pour ajouter un commentaire.

Vous êtes déjà membre ?

Connectez-vous

Pas encore membre ?

Devenez membre gratuitement

17/12/2022 - Indice/Marchés

15/12/2022 - Economie/Forex Indice/Marchés

22/04/2022 - Indice/Marchés

22/04/2022 - Indice/Marchés

21/04/2022 - Indice/Marchés

20/04/2022 - Indice/Marchés

19/04/2022 - Indice/Marchés

15/04/2022 - Indice/Marchés

15/04/2022 - Indice/Marchés

17/12/2022 - Indice/Marchés

![[Orishas-finance] : ORISHAS FUNDS360 - Les données du marché africain s'offrent à vous](/uploads/news/859fd87b75b5b18da5e7104b992d6394.jpg)

15/12/2022 - Economie/Forex Indice/Marchés

22/04/2022 - Indice/Marchés