Les actualités de la BRVM en Flux RSS

Les actualités de la BRVM en Flux RSS

Nous agrégeons les sources d’informations financières spécifiques Régionales et Internationales. Info Générale, Economique, Marchés Forex-Comodities- Actions-Obligataires-Taux, Vieille règlementaire etc.

Enjoy a simplified experience

Find all the economic and financial information on our Orishas Direct application to download on Play StoreEuropean stocks finished higher on Wednesday, buoyed by new Wall Street records for the S&P 500 and the Nasdaq Composite, before the minutes of the Federal Reserve's last meeting were released.

The measures taken by the Fed to mitigate the damage caused by the coronavirus crisis have helped to take riskier assets to unprecedented levels while reducing demand for safe havens and the dollar.

The day was again poor in indicators with, in the eurozone, only the confirmation of inflation at +0.4% over one year in July.

Meanwhile, British inflation accelerated to 1% last month, the highest since March, after +0.6% in June.

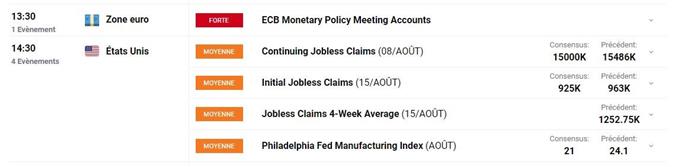

This Thursday, the minutes of the European Central Bank will be in the spotlight as well as the number of weekly unemployment registrations in the United States.

Thus, the CAC 40 index increased 0.79% to 4,977.23 points. Footsie gained 0.58% and DAX 30 advanced 0.74%.

Wall Street ended a lower session Wednesday despite new records on the Standard & Poor's 500 and the Nasdaq, as the minutes of the Federal Reserve's latest meeting revived fears about the fragility of the economic recovery amid the pandemic.

On Wednesday, the indices moved slightly higher until the report of the last meeting of the Fed's Monetary Policy Committee was released during the session. Several central bank officials consider the recent economic and employment recovery fragile and uncertain while ruling out measures such as capping Treasury yields.

Inparticular, participants at the meeting stressed that uncertainty surrounding the economic outlook remained very high, with the economic trajectory heavily dependent on the trajectory of the virus and on the public sector's response to it, i.e. on the adoption of a new aid plan.

However, the White House and Democratic members of Congress have been discussing new aid measures for businesses and households, as well as local authorities and schools, for several weeks, without being able to reach an agreement.

Moreover, “the labor market is far from a complete recovery”, even after the significant number of job creations observed in May and June, pointed out the members of the Fed's Monetary Committee.

Today's session was also marked by Apple, which became the first American company to exceed the $2 trillion mark on the stock market before losing some ground.

As aresult, the Dow Jones lost 0.31% to 27,692.88 points. The Nasdaq fell by 0.57% and the S&P-500 dropped 0.44%.

In July, the greenback suffered its largest monthly fall in ten years (-4.15%), largely due to concerns about the pandemic and the economic recovery in the United States, the trade dispute between Washington and Beijing, and the lack of consensus on new support measures.

The euro fell below 1.19 dollars after reaching a high of more than two years against the American currency touched on Tuesday at 1.1965.

been on the decline for a long time, oil prices have returned almost to balance after EIA announced a smaller than expected drop in crude stocks in the United States last week (-1.6 million barrels compared with -2.67 million expected) and a sharper than expected decrease in gasoline inventories.

US light crude WTI gained 0.14% to $42.95 per barrel and North Sea Brent reduced its losses and fell 0.11% to $45.41.

Today's economic calendar:

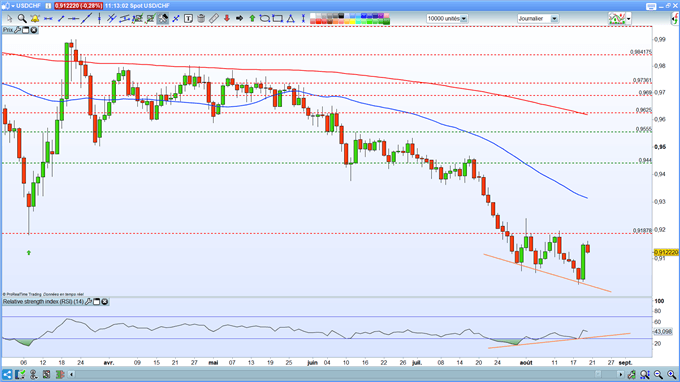

CHART OF THE DAY — USD/CHF: END OF CONSOLIDATION

After a real plunge for several weeks, the US dollar could pick up a bit in the coming sessions. First of all, the previous day's candlestick is characterized by a flowing and impulsive candle, indicative of buying strength. Moreover, this pattern takes the form of a bullish downturn.

Then, the RSI indicator confirmed a bullish divergence, so the pair should mark a short-term low point and attempt a technical rebound. The first level to cross is that of 0.9185 and then to seek the final objective towards the 50-period moving average at 0.9290.

Vous devez être membre pour ajouter un commentaire.

Vous êtes déjà membre ?

Connectez-vous

Pas encore membre ?

Devenez membre gratuitement

17/12/2022 - Indice/Marchés

15/12/2022 - Economie/Forex Indice/Marchés

22/04/2022 - Indice/Marchés

22/04/2022 - Indice/Marchés

21/04/2022 - Indice/Marchés

20/04/2022 - Indice/Marchés

19/04/2022 - Indice/Marchés

15/04/2022 - Indice/Marchés

15/04/2022 - Indice/Marchés

17/12/2022 - Indice/Marchés

![[Orishas-finance] : ORISHAS FUNDS360 - Les données du marché africain s'offrent à vous](/uploads/news/859fd87b75b5b18da5e7104b992d6394.jpg)

15/12/2022 - Economie/Forex Indice/Marchés

22/04/2022 - Indice/Marchés