Les actualités de la BRVM en Flux RSS

Les actualités de la BRVM en Flux RSS

Nous agrégeons les sources d’informations financières spécifiques Régionales et Internationales. Info Générale, Economique, Marchés Forex-Comodities- Actions-Obligataires-Taux, Vieille règlementaire etc.

Enjoy a simplified experience

Find all the economic and financial information on our Orishas Direct application to download on Play StoreDuring the week of May 11 to 15, 2020, corresponding to a wave of relaxation of social distancing measures, the BRVM's "weather report" reports the preponderance of the old herd reflexes of humanity over the rationality that should dictate the deed of purchase or sale.

In the United States, the governor of New York State, who reports 20,000 deaths due to COVID-19, has thus extended confinement until June 13. This decision portends an ever more severe economic and social impact on the world's largest economy. The latest report on the evolution of retail sales confirms this situation. Indeed, the data indicates a drop of 16.4% during the month of April, the worst performance for 50 years.

Faced with this situation, the President of the Federal Reserve, Jerome Powell, called for a new budgetary support plan in order to limit the economic damage and promote a strong economic recovery. Remember that the US Congress has already provided 2,900 billion dollars, or 14% of the country's Gross Domestic Product (GDP), through aid granted to households and businesses in particular. Elsewhere in the world, Germany confirmed its entry into recession with a 2.2% contraction of its economy during the 1st quarter of 2020. If this evolution remains better than that of the whole Euro (-3.8%), economists nevertheless expect an acceleration of the trend in the second quarter, where a decline of 10% in GDP is expected. For its part, Saudi Arabia suffered the brunt of the collapse in oil prices. The Kingdom has announced an austerity plan whose main measures will be the tripling of the Value Added Tax (VAT) as well as the cessation of the monthly allowances paid to its citizens. In financial markets, the renewed pessimism induced by economic figures was reflected in the performance of stock market indices. The weekly results are thus negative on all the stock markets, with the exception of Argentina, whose benchmark index recorded a jump of 9%.

At the regional level

The gradual return to normal is following its course in the WAEMU zone. Thus in Côte d'Ivoire, following a National Security Council held on May 14, several restrictive measures were relaxed. The curfew, imposed since the end of March, was lifted while the limit on gatherings was raised to 200 people instead of 50 previously. At the same time, the States continue to prepare their response plans via fundraising on the public securities market. Côte d'Ivoire carried out its third issue of "COVID-19 social vouchers", for an amount of 175 billion FCFA. It was followed by Niger, which raised 110 billion FCFA for its first issue, and Togo for 108 billion FCFA. On the regional financial market, listed securities generally underperformed, illustrated by the 0.46% decline in the BRVM Composite, the composite index for the entire market. However, the BRVM 10 index, made up of the ten (10) most active stocks on the stock exchange, made a significant gain of 0.38% over the period:

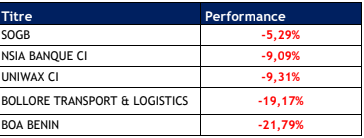

The biggest drops over the week (flop 5) at the BRVM

The biggest drops over the week (flop 5) at the BRVM

The SOGB stock, still weighed down by weak rubber and palm oil prices, fell 5.29% over the week. It is followed by NSIA Banque CI, which lost 9%, without any particular event seeming to justify this downward trend. In addition, investors continue to penalize the UNIWAX CI stock (-9.31%), in connection with the deterioration of its financial performance over the 1st quarter of the year, which saw its turnover and its result decline. tumble by 16% and 70% respectively. Bolloré Transport & Logistics CI makes a new foray into this flop 5, with a weekly drop of 19.17%. After reaching its highest level of the year at the end of February, the price of the title collapsed by 28.6%. Investors seem to be anticipating a significant impact from the pandemic on the company's business. The biggest drop of the week was made by the title BOA Benin, which recorded a sharp drop of 21.79% in its price. This heavy drop seems to be due to profit-taking by investors following the rise of almost 17% recorded during the month of April.

Vous devez être membre pour ajouter un commentaire.

Vous êtes déjà membre ?

Connectez-vous

Pas encore membre ?

Devenez membre gratuitement

17/12/2022 - Indice/Marchés

15/12/2022 - Economie/Forex Indice/Marchés

22/04/2022 - Indice/Marchés

22/04/2022 - Indice/Marchés

21/04/2022 - Indice/Marchés

20/04/2022 - Indice/Marchés

19/04/2022 - Indice/Marchés

15/04/2022 - Indice/Marchés

15/04/2022 - Indice/Marchés

17/12/2022 - Indice/Marchés

![[Orishas-finance] : ORISHAS FUNDS360 - Les données du marché africain s'offrent à vous](/uploads/news/859fd87b75b5b18da5e7104b992d6394.jpg)

15/12/2022 - Economie/Forex Indice/Marchés

22/04/2022 - Indice/Marchés