Les actualités de la BRVM en Flux RSS

Les actualités de la BRVM en Flux RSS

Nous agrégeons les sources d’informations financières spécifiques Régionales et Internationales. Info Générale, Economique, Marchés Forex-Comodities- Actions-Obligataires-Taux, Vieille règlementaire etc.

Enjoy a simplified experience

Find all the economic and financial information on our Orishas Direct application to download on Play Store

The United States overtakes Switzerland in the global ranking of hotbeds of financial secrecy, the Cayman Islands both overtake and find themselves at the top of the index.

The United States overtook Switzerland in the global ranking of countries most complicit in helping individuals who want to hide their finances from the rule of law - but the Cayman Islands overtook both, to rank as the worst offenders. The Tax Justice Network's Financial Secrecy Index 2020, released today, found that financial secrecy around the world is decreasing thanks to recent transparency reforms. On average, countries on the index have reduced their contribution to global financial secrecy by 7%.

But a handful of countries that account for a significant share of global financial services have bucked this trend, including the United States, the Cayman Islands and the United Kingdom. With Switzerland finally making enough progress to leave the top of the index, an Anglo-American axis of opacity now poses by far the greatest global threat of corruption and tax abuse. The Tax Justice Network calls on policymakers to prioritize sanctions against those countries that have downgraded.

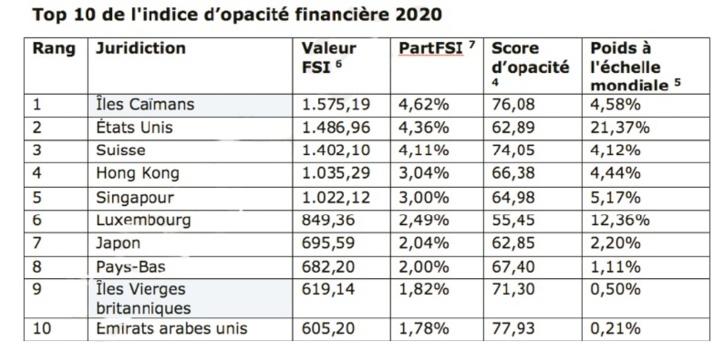

The sixth edition of the biannual Financial Secrecy Index sees Switzerland reduce its ranking to third as the biggest enabler of financial secrecy in the world. This is the first time the country has not been ranked worst on the index since 2011. Despite their increased contribution to global financial secrecy since the publication of the 2018 edition of the index, the United States remains the second biggest catalyst for global financial secrecy after the Cayman Islands overtook them and Switzerland to lead the 2020 index. This is the first time that the Cayman Islands top the Financial Secrecy Index. The top 10 enablers of financial secrecy in the world are currently:

Cayman Islands

United States

Swiss

hong kong

Singapore

Luxemburg

Japan

Netherlands

British Virgin Islands

United Arab Emirates

The Financial Secrecy Index ranks each country on the extent to which its legal and financial systems allow wealthy individuals and criminals to hide and launder money taken from around the world. The index ranks each country's legal and financial system with a score of opacity out of 100, where zero out of 100 corresponds to complete transparency and 100 out of 100 means complete opacity. The country's secrecy score is then combined with the volume of financial activity conducted by non-residents within the country to calculate the intensity of financial secrecy provided to the world by that country.1

A higher ranking in the index does not necessarily mean that a jurisdiction is more opaque, but rather that the jurisdiction plays a more prominent role globally by allowing bank secrecy, anonymous ownership of shell companies, ownership of real estate or other forms of financial secrecy, which in turn enable money laundering, tax evasion and huge offshore concentrations of untaxed wealth. A highly opaque jurisdiction that provides little or no financial services to non-residents, such as Samoa (ranked 86th), will rank below a moderately opaque jurisdiction that is a major global player, such as Japan (ranked 7th).

Breakdown of top ranking changes in the Financial Secrecy Index

The Cayman Islands are now the biggest enabler of financial secrecy in the world

The Cayman Islands increased its offer of financial secrecy to the world by 24%, moving it from third place on the 2018 index to first in 2020. This deterioration is due to a 21% increase in the volume of financial services they provide to non-residents. This is also partly due to a 4-point increase in their Opacity score, from 72 to 76 out of 100, after the Cayman Islands failed to keep up with methodological updates to the Opacity Index. financial secrecy that reflect the evolving nature of the financial secrecy landscape.2 The growth of the Cayman Islands' global role highlights the major risks arising from the hedge fund industry, which uses hidden companies, trusts and limited partnerships in opacity.

How the United States overtook Switzerland

So far, the United States has failed to meet ambitions to improve its ranking in the Financial Secrecy Index expressed last year by Senator Lindsey Graham during a hearing before the Senate Committee . Chairing the Senate Committee Hearing “Combating Kleptocracy: Beneficial Ownership, Money Laundering and Other Reforms,” Senator Lindsey Graham said3:

“According to the Tax Justice Network…we are second only to Switzerland in terms of havens for money laundering…We will find a way not to be second. We will find a way to make it more difficult to store stolen money in the United States.

The United States remained in second place in the 2020 edition of the Financial Secrecy Index and even increased its offer of financial secrecy to the world by 15%. Switzerland, on the other hand, cut its offer of financial secrecy by 12%, causing the United States to overtake Switzerland in this index. On average, the countries on the index have reduced their supply by 7%.

The increase in supply in the United States is mainly the result of the deterioration of its opacity score, which increased by 3 points (to 63 out of 100), largely due to the adoption of a new law in New Hampshire allowing the creation of non-charitable private foundations without having to publish it. The reduction in Switzerland's financial secrecy offer is partly explained by the fact that it reduced its secrecy score by 2 points (74 out of 100) after increasing the number of countries with which it trades automatically information under the Common Reporting Standard. The United States has yet to join the common reporting standard, which currently has 105 signatories. The reduction in the supply of financial secrecy in Switzerland is also partly due to a reduction in the volume of financial activity carried out within the country by non-residents.

Clark Gascoigne, Acting Executive Director of the US-based Corporate Financial Accountability and Transparency (FACT) Coalition, said:

“As the data clearly shows, financial secrecy remains a major problem in the United States, enabling crimes such as human trafficking, tax evasion and corruption, both at home and abroad. . Fortunately, there is reason to be optimistic. Research like the Financial Secrecy Index has fostered bipartisan recognition of the problem. The US House of Representatives in October passed a bipartisan measure - the "CorporateTransparency Act" - to end corporate abuse. A similar law, known as the Illicit Cash Act, is currently being considered by the Senate Banking Committee. After more than a decade of debate, 2020 should be the year the United States finally enacts significant transparency reforms to better protect our financial system from abuse.

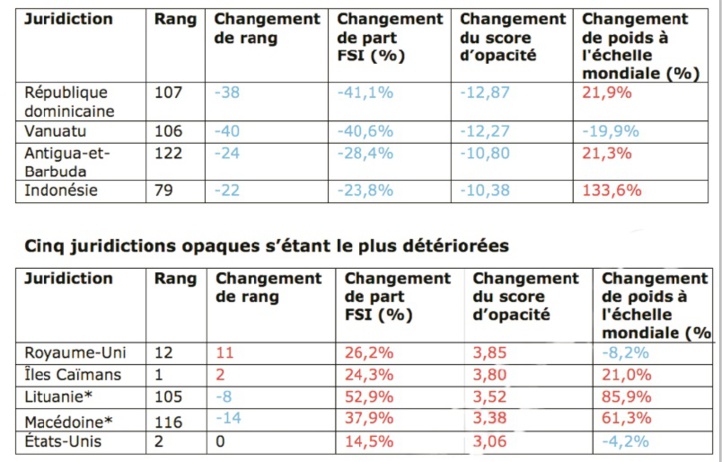

The UK is increasing financial secrecy within the country and across its web

The UK has increased its secrecy score more than any other country. While countries on the Financial Secrecy Index on average decreased their secrecy score by 3 points out of 100, the UK increased its score by 4 points, from 42 to 46 out of 100. 7Tolerance increase in financial secrecy practices in the UK led it to increase its global financial secrecy offering by 26%, catapulting the country from 23rd place on the 2018 index to 12th place on the 2020 index. By comparison, the other countries in the index have on average reduced their offer of financial secrecy by 7%.

The increase in financial secrecy in the UK has extended to its network of satellite jurisdictions to which it outsources part of its financial secrecy activity. Often referred to as Britain's spider's web, the network is made up of overseas territories and Crown dependencies where the UK has full powers to impose or veto law-making, and where the power to appoint key government officials rests with the Crown.

At the center of the network is the City of London, which receives and launders the wealth brought in by the satellite jurisdictions.

The UK spider's web includes some of the jurisdictions ranked at the top of the Financial Secrecy Index, including the Cayman Islands, which is ranked first in the index, the British Virgin Islands

ranked 9th and Guernsey which occupies the 11th place. The satellite jurisdictions that make up the UK spider's web have on average increased their offer of financial secrecy to the world by 17%, which is more than double the rate at which countries around the world have on average reduced their offer of financial secrecy. global financial opacity. If the UK and its network of Overseas Territories and Crown Dependencies were treated as a single entity, this UK spider web would rank first on the index.

John Christensen, director and founder of the Tax Justice Network, said:

“The UK showed the world real leadership in 2016 by being the first country to adopt a public register of beneficial owners – now that progress has been reversed. The UK's surge in the Financial Secrecy Index raises serious concerns about its post-Brexit strategy to turn the City of London into a 'Singapore on the Thames'. This should be of particular concern for EU countries which have collectively reduced their offer of financial secrecy to the world by 8% while the UK has increased its offer by 26%”.

“A more secretive and poorly regulated City of London is bad news for everyone, including Britons. Evidence shows that the UK's oversized financial sector cost the UK economy £4.5 trillion in lost economic output between 1995 and 2015 - the equivalent of £67,500 per person in the UK. A post-Brexit 'Singapore on the Thames' strategy would see more money taken from Britons and the rest of the world and poured into the pockets of the wealthy”.

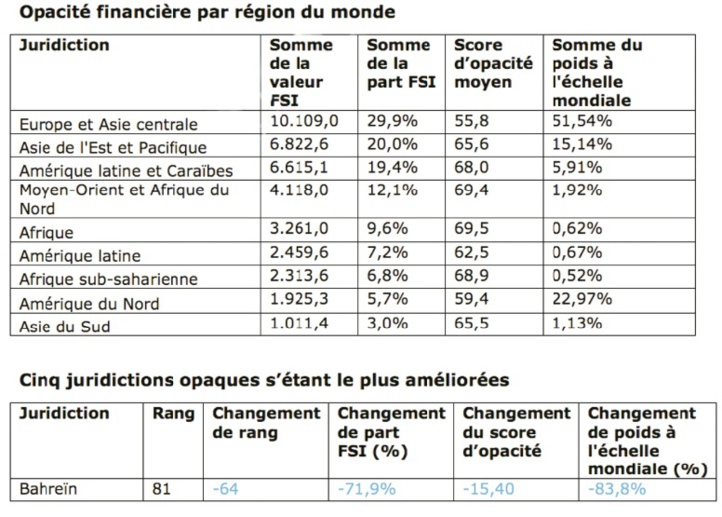

OECD countries are responsible for nearly half of the world's financial secrecy

OECD countries are responsible for 49% of all financial secrecy in the world, as determined by the Financial Secrecy Index 2020. OECD countries directly provided 35% of global financial secrecy measured by the index and 14% through their dependencies to which they outsource some of their financial secrecy, including dependencies like the US Virgin Islands and Curacao, as well as the dependencies that make up the UK Spider's Web .

Secrecy scores for OECD countries and their dependencies reveal hypocrisy in the fight against financial secrecy. OECD countries got an average opacity score of 54 out of 100 while their dependencies got an average opacity score of 73. In comparison, non-OECD countries (excluding OECD dependencies OECD) have an average secrecy score of 67 out of 100. By externalizing financial secrecy to their dependencies, OECD countries enable some of the worst forms of financial secrecy in the world while enforcing stricter regulations on financial secrecy within their own borders.

Germany cuts financial secrecy by a third after resisting OECD and positioning itself in favor of transparency

Germany has significantly reduced its offer of financial secrecy to the world (35%), dropping its ranking from 7th place in the 2018 index to 14th place in the 2020 one. This reduction is mainly due to the fact that Germany improved its secrecy score by 7 points to 52 out of 100, after making several improvements to beneficial ownership registration requirements. These include requiring foreign corporations, partnerships and trusts to disclose the identity of their beneficial owners. Germany has now posted beneficial ownership information online.

Germany avoided deteriorating its improved secrecy score by breaking ranks with the OECD in favor of stronger country-by-country reporting laws. The OECD guidelines only allow countries to request country-by-country reports locally from local subsidiaries of multinational corporations only as a last resort, after a number of conditions have been met.

Germany was among 19 countries on the 2018 edition of the Financial Secrecy Index that made it easier for local authorities to request country-by-country reporting directly from local subsidiaries, even though OECD conditions have not been fulfilled. Of these 19 countries, 10 have now changed their laws to comply with OECD guidelines, which has had a negative effect on their secrecy score. These include the UK, which has soared in the Financial Secrecy Index rankings, Hong Kong and Jersey. Germany failed to change its country-by-country reporting laws to comply with OECD guidelines, allowing it to achieve the largest-ever reduction in its contribution to global financial secrecy. However, Germany continues to play a key role in preventing the European Union from adopting a more ambitious and binding country-by-country reporting standard.

Luanda Leaks: Angola is the second most opaque country in the world

The 2020 edition of the Financial Secrecy Index is the first to rank Angola. The country plays a minor role in the global supply of financial services to non-residents, but it is very opaque. Angola ranked 35th among the biggest enablers of financial secrecy in the world and achieved a secrecy score of 80 out of 100 - the second highest secrecy score of any country, after the Maldives.

Global Financial Secrecy Is Shrinking: Successes of Reforms and Looking Ahead

The global financial secrecy total measured by the Financial Secrecy Index has fallen sharply by 7% since 2018. This reduction would be equivalent to removing the contributions of Switzerland and the United Arab Emirates from the 2018 edition of the index. - who were ranked 1st and 9th respectively. Reduction means less room for practices such as secret banking, anonymous ownership of shell companies or anonymous ownership of real estate, which subsequently means less room for money laundering, tax evasion and huge offshore concentrations of illicit and untaxed wealth.

The 2020 Financial Secrecy Index shows that the biggest reforms have been in automatic exchange of information and beneficial ownership registration while reforms in country-by-country reporting 14 have been weak. These three areas of reform, also known as the ABCs of tax justice, have received the most attention from activists, tax experts and policy makers in recent years.

The Financial Secrecy Index bases each country's secrecy score on 20 indicators, each of which is scored out of 100. The average of the 20 indicator scores becomes the country's overall secrecy score. The 20 indicators fall into four categories: one tracks countries' performance on automatic exchange of information between other practices, another tracks performance on beneficial ownership registration, and two tracks performance on declarations. country by country.

The largest reduction in indicator scores occurred in the category measuring countries' implementation of automatic exchange of information, which saw countries reduce their score by 9 points out of 100 on average. This is mainly due to more countries automatically exchanging information under the Common Reporting Standard. Countries have on average reduced their score on property registration, including beneficial ownership registration, by 4 out of 100 points. progressed. On average, countries reduced their scores in both categories by 0.4 points out of 100.

Liz Nelson, director at the Tax Justice Network, said:

“The far-reaching reforms that have been made in recent years that have led to a global reduction in financial secrecy were deemed unachievable when the first Financial Secrecy Index was released a decade ago. However, progress on country-by-country reporting remains slow, leaving unchecked the widespread tax abuse that disproportionately undermines people who start out with fewer opportunities in life. Women, minorities and people with disabilities are more likely to foot the bill left behind by tax evaders and be prevented from leading meaningful and fulfilling lives. The OECD currently has a unique opportunity to reform an international tax regime that has allowed financial secrecy to flourish”.

(To be continued)

“While countries have dragged their feet in introducing country-by-country public reporting, companies around the world have voluntarily started publishing their country-by-country reporting under the new GRI (Global Reporting Initiative) tax standard. The GRI Tax Standard released last year provides the highest quality public country-by-country reporting data, as formulated by experts from all stakeholder groups, including multinational corporations and accounting firms. We urge the OECD to adopt the strong transparency measures that responsible companies and civil society groups have already voluntarily adopted”.

Recommendations: "The world has begun to win the fight against financial secrecy"

The Financial Secrecy Index 2020 shows that strong international standards for transparency can be effective in generating meaningful progress. The Tax Justice Network recommends three immediate actions:

1- Countermeasures. Governments increasingly recognize the harmful consequences of financial secrecy and have begun to take steps to reduce it. To truly eradicate financial secrecy, meaningful countermeasures are now needed against jurisdictions and their economic actors who refuse to cooperate, regardless of their economic power.

2- Transparency of corporate taxation.

As the OECD revises its country-by-country reporting standard this year, it needs to address key technical shortcomings of the current standards and converge on the new Global Reporting Initiative (GRI) tax standard. Governments, including those in the EU that have repeatedly fallen behind, must follow the lead of large companies that now voluntarily report such data and make its publication mandatory.

3- Anonymous property. The Financial Action Task Force17 should add to its binding recommendations public registration of beneficial owners and legal owners of all legal entities.

Alex Cobham, Managing Director of Tax Justice Network, said:

“The world has started to win the fight against financial secrecy, and that's good news for everyone. Financial secrecy has allowed drug cartels to remain bankable, tax abuses to remain possible and human trafficking to remain profitable - but the majority of countries are now making it clear that this is not the world we want. Creating a fair world that treats all members of society equally means reprogramming our financial and tax systems to operate on the basis of transparency, not opacity, making it impossible for criminals and elites from hiding and ensuring that countries have enough resources and are well governed to support everyone to lead meaningful and fulfilling lives. We still have a lot of work to do - our governments need to keep their feet on the pedals”.

“It is deplorable, however, that in the face of such progress, an Anglo-American axis of opacity has knowingly chosen to continue practices that exacerbate corruption, tax evasion and global inequality. Polls18 show that citizens in the United States and the United Kingdom favor greater transparency and progressive taxation - but if their governments are unwilling to do so, politicians in other countries must actively consider alternatives. countermeasures”.

Note

1- Following a methodology developed by the IMF in 2007, the index uses IMF Balance of Payments statistics on financial services exports and other IMF data on cross-border financial activity to determine the volume financial activity carried out in each country by non-residents. Global weight represents a jurisdiction's share of global financial services exports. The greater a country's weight on the global scale, the more responsibility it has to reduce financial opacity. A highly opaque jurisdiction that provides few or no financial services to non-residents will ultimately be responsible for a small share of global financial secrecy, while a moderately secretive jurisdiction that is a major global player will contribute to a highest share of global financial secrecy and will rank higher in the financial secrecy index.

2- The methodology of the Financial Secrecy Index is periodically updated to take into account the evolving nature of the financial secrecy landscape, in the same way that a firewall is updated to protect against newly exposed vulnerabilities. The methodology for 2020 saw a stricter assessment of irregularities and unique combinations of loopholes that can be used to ensure financial secrecy. This resulted in increased opacity scores for a few countries that had not made significant regulatory changes to their financial or tax systems.

3- New Hampshire enacted Chapter 564-F - The New Hampshire Foundation Act at the end of 2017, after the deadline for evaluating jurisdictions for the 2018 edition of the Financial Secrecy Index. This law allows the establishment of private foundations without having to reveal the identity of the founders, beneficiaries or beneficial owners.

4- The Common Reporting Standard requires jurisdictions to collect information about the financial activities of non-resident individuals, corporations, and legal entities and automatically exchange that information with the jurisdiction in which the person, corporation, or legal entity resides. The Common Reporting Standard was introduced by the OECD in July 2014 and has steadily seen a growing number of countries join it and increase the number of countries with which they exchange information. The Tax Justice Network first used the practice of automatic exchange of information in 2005, at a time when the practice was still considered by many to be impossible to implement.

5- The United States has not adhered to the common reporting standard. Instead, they put in place their own standard, the Foreign Account Tax Compliance Act (FATCA). Under FATCA, countries that have signed up to exchange information with the United States do not receive information back. Some countries receive no feedback while some have partial reciprocity where some basic information is shared. It is important to note that the United States does not share beneficial ownership information, which allows non-residents to hide their bank accounts in the United States by holding them through legal entities.

6- The UK's opacity score has increased by 4 points, in part because it no longer allows local authorities to directly request country-by-country reporting from local subsidiaries if OECD requirements are not met respected. The UK has aligned its country-by-country reporting laws with the OECD framework, which has reduced the stringency of country-by-country reporting requirements. The increase in the secrecy score is also partly due to the UK's failure to keep up with methodological updates to the Financial Secrecy Index which reflect the evolving nature of the financial landscape. financial opacity.

7- The British Spider's Web includes the following British Overseas Territories and Crown Dependencies: Cayman Islands, British Virgin Islands, Guernsey, Jersey, Gibraltar, Bermuda, Isle of Man, Anguilla, Turks-and -Caicos and Montserrat.

8- The Sheffield Political Economy Research Institute (SPERI) at the University of Sheffield has published a report entitled “The UK's Finance Curse? Costs and Processes” revealing that the UK suffered a cumulative cost of £4.5 trillion in lost economic output from 1995 to 2015, equivalent to around 2.5 years of average GDP over the period.

9- The dependencies of the OECD, excluding the British spider web, are: Aruba, Curacao, Puerto Rico and the US Virgin Islands.

10- Automatic exchange of information involves countries automatically sharing information about the financial activities of non-resident individuals, companies and legal entities with the jurisdiction in which the individual, company or legal entity resides. Automating information sharing removes barriers, delays and policies that have discouraged international cooperation and helped maintain financial secrecy. The Tax Justice Network first used the practice of automatic exchange of information in 2005, at a time when the practice was still considered by many to be impossible to implement.

11- The beneficial owner is the real person, made of flesh and blood, who ultimately owns, controls or receives profits from a business or legal entity, even when the business is legally owned by another person, such as a broker or shell company. Businesses generally need to record the identity of their legal owners, but not necessarily their beneficial owners. In most cases, the legal owner and the beneficial owner of a business are the same person. But when they aren't, the beneficial owners can hide behind the legal owners, making it virtually impossible to know who is actually running and profiting from a business. Mossack Fonseca, the offshore services provider at the heart of the Panama Papers scandal, did not know who the beneficial owners of more than 70% of the 28,500 active companies to which it provided services were, despite being the legal owner of some of them. these companies. Beneficial ownership registration involves the requirement for legal entities to register the identity of their beneficial owners in addition to that of their legal owners.

12- Country-by-country reporting is a practice that requires companies to publish information about the profits and costs they incur in each country in which they operate, instead of publishing only an aggregate summary of their profits and costs at the national level in a single aggregate. By breaking down profits and costs by country, citizens and local authorities can see if multinationals are illegally shifting profits out of the country by passing them off as costs to avoid tax. The first draft accounting standard for CbC reporting was developed by the Tax Justice Network in 2003. The publication of CbC reporting data is a powerful deterrent against profit shifting.

13- The GRI Tax Standard, published in December 2019, is the first global standard for comprehensive tax reporting at country-by-country level. It supports reporting on a company's business activities and payments within tax jurisdictions, as well as its tax strategy and approach to governance. The standard was developed in consultation with global investors, civil society groups, labor organizations, accounting firms and tax experts, as it will help meet their growing demand for tax transparency. The GRI Tax Standard offers the highest quality of country-by-country public reporting, which was proposed in 2003 as an international accounting standard by the Tax Justice Network.

14- Examples of countermeasures that countries could take against the worst offenders:

The Tax Justice Network does not propose blacklisting, given the history of politicization and the failure of this approach. The Financial Secrecy Index confirms that there is no binary distinction between “good” and “bad” jurisdictions, but rather a spectrum of degree of secrecy in which all countries have room for improvement. make. To this end, we propose countermeasures that directly affect economic actors in less transparent jurisdictions. Clear examples include an approach based on US FATCA, where financial institutions may be subject to withholding taxes if they do not participate in the automatic exchange of information. A “reverse FATCA”, targeting US financial institutions which are by far the largest non-participating financial center, would provide immediate leverage over the EU or others who might follow such an approach. Less dramatically, governments can directly address the threat posed by secrecy jurisdictions' opaque companies operating in their territories, by imposing stricter standards. Companies, trusts and foundations from jurisdictions that do not require public declaration of beneficial owners, for example, may be required to provide such declaration as part of the operating requirements in other countries. Multinationals that are not required by their headquarters to publish their country-by-country reports may be required to do so.

15- The Financial Action Task Force (FATF) is an intergovernmental body created in 1989 by the ministers of its member jurisdictions. The objectives of the FATF are to set standards and promote the effective implementation of legal, regulatory and operational measures to combat money laundering, terrorist financing and other related threats to the integrity of the financial system international. The FATF has developed a series of recommendations which are recognized as the international standard for combating money laundering, terrorist financing and the proliferation of weapons of mass destruction. The FATF monitors the progress of its members in implementing the necessary measures, reviews money laundering and terrorist financing techniques and countermeasures, and promotes the adoption and implementation of appropriate measures worldwide.

The FSI value is calculated by multiplying the cube of the opacity score by the cube root of the worldwide weight. The final result is divided by one hundred for clarity of presentation.

The FSI share is calculated by adding all the FSI values, then dividing each country's FSI value by the total sum, expressed as a percentage.

Opacity scores are scored out of 100, where zero out of 100 means full transparency and 100 out of 100 means full opacity. Opacity scores are based on 20 indicators.

Global weight represents a jurisdiction's share of global financial services exports. It indicates the volume of financial activity carried out in the country by non-residents.

Although Lithuania and Macedonia increased their secrecy scores and the volume of financial activities conducted in their jurisdiction by non-residents, they both fell in the rankings due to the addition of new countries to the list. Financial Secrecy Index 2020, countries that all ranked above Lithuania and Macedonia.

* About Tax Justice Network

The Tax Justice Network believes that a fair world, where everyone has the opportunity to lead a meaningful and fulfilling life, can only be built on a fair tax code, where each of us contributes a fair share to a society we all want. Our tax systems, dominated by powerful corporations, have been programmed to ask the least of the corporations and wealthy elites who extract the most from society, and ask more of the public to give much less in return. The Tax Justice Network is fighting to right this injustice. Every day, we equip citizens and governments everywhere with the information and tools they need to reprogram their tax and financial systems to work for everyone.

Vous devez être membre pour ajouter un commentaire.

Vous êtes déjà membre ?

Connectez-vous

Pas encore membre ?

Devenez membre gratuitement

17/12/2022 - Indice/Marchés

15/12/2022 - Economie/Forex Indice/Marchés

22/04/2022 - Indice/Marchés

22/04/2022 - Indice/Marchés

21/04/2022 - Indice/Marchés

20/04/2022 - Indice/Marchés

19/04/2022 - Indice/Marchés

15/04/2022 - Indice/Marchés

15/04/2022 - Indice/Marchés

17/12/2022 - Indice/Marchés

![[Orishas-finance] : ORISHAS FUNDS360 - Les données du marché africain s'offrent à vous](/uploads/news/859fd87b75b5b18da5e7104b992d6394.jpg)

15/12/2022 - Economie/Forex Indice/Marchés

22/04/2022 - Indice/Marchés