Les actualités de la BRVM en Flux RSS

Les actualités de la BRVM en Flux RSS

Nous agrégeons les sources d’informations financières spécifiques Régionales et Internationales. Info Générale, Economique, Marchés Forex-Comodities- Actions-Obligataires-Taux, Vieille règlementaire etc.

Enjoy a simplified experience

Find all the economic and financial information on our Orishas Direct application to download on Play StoreIn the race for “official” cryptocurrencies, the European Central Bank is lagging behind the People's Bank of China, which is already testing its digital yuan, which could be formalized in a year. The bet against the dollar is not as widespread as expected, which should not prevent the Turkish lira from recovering against the greenback, according to Société Générale experts.

The digital euro could see the light of day within 5 years, the President of the European Central Bank, Christine Lagarde, estimated this week. An ECB survey shows that the main asset for potential users would be confidentiality, far ahead of security (17%) or the pan-European nature of the currency (10%). The study generated a record number of responses for this type of questionnaire, the ECB is delighted, even though the number of advanced respondents, 8,221 “citizens, businesses and professional associations”, seems ridiculously low at the Community level. The Governing Council of the ECB is due to decide in a few weeks whether work has begun. The central bank believes that Europe should equip itself with this type of tool, to counter the emergence of private initiatives such as Facebook's Libra or its counterparts' cryptocurrencies, such as the PBOC's digital yuan, currently being tested for a launch that could take place in a year... and not in

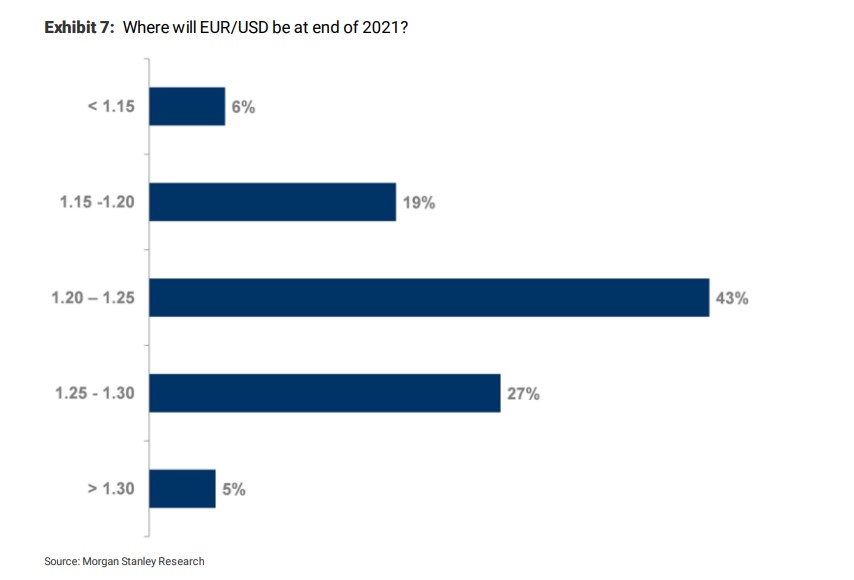

We are talking again about the inevitable dollar this week, which reversed the trend against the euro, taking advantage of the tightening of lockdown measures on the old continent and the ongoing political rififi in Italy. As our colleague Patrick Réjaunier, 40 years of markets, would say, “when everyone is bearish on the dollar, it's because it will go up”. The greenback rose from 1.23 to 1.215 against the single currency. But are bets still unfavorable to the dollar? Not really, according to the latest investor survey released yesterday by Morgan Stanley. “The weakness of the dollar is a very consensual macroeconomic vision at the moment, but we saw only limited proof of it in our survey,” explains the American bank, which notes that 43% of investors expect the EURUSD pair to end the year largely unchanged, between 1.20 and 1.25. Only a third of the professionals surveyed expect to reach the 1.25 mark by the end of the year. But a quarter also sees EURUSD below 1.20,

Where will the dollar be at the end of the year, Morgan Stanley asks its client-investors?

In the latest version of its trading ideas on rates and currencies, Société Générale recommends that its clients shorten the USDTRY pair. “Under the leadership of the new CBRT governor, Naci Ağbal, and the new finance minister, Lütfi Elvan, Turkey seems to be returning to more orthodox policies,” the bank said, which believes the Turkish lira will recover. However, three indicators need to be monitored. First, the evolution of “dollarization”, to verify that the Turks regain confidence in their currency. Secondly, the ability of the monetary authorities to follow up on the commitments that have been made recently. Finally, the absence of international sanctions from Europe or the United States. The USDTRY is currently trading at 7.39545. The SG is also bearish on EURTRY

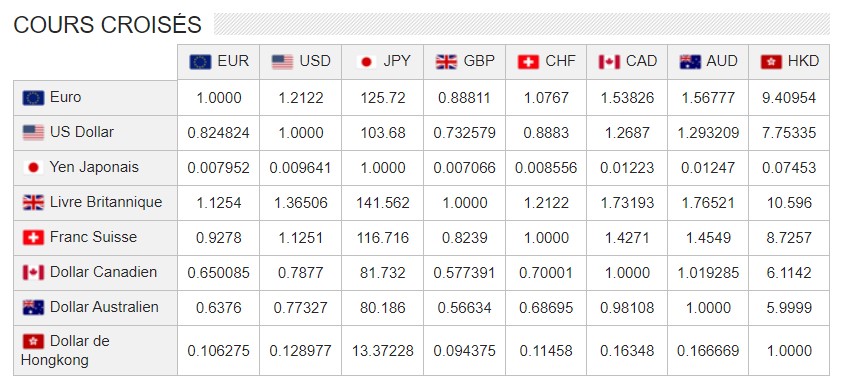

Crosstab of the main currency pairs

Vous devez être membre pour ajouter un commentaire.

Vous êtes déjà membre ?

Connectez-vous

Pas encore membre ?

Devenez membre gratuitement

15/12/2022 - Economie/Forex Indice/Marchés

22/04/2022 - Economie/Forex

22/04/2022 - Economie/Forex

21/04/2022 - Economie/Forex

21/04/2022 - Economie/Forex

21/04/2022 - Economie/Forex

20/04/2022 - Economie/Forex

20/04/2022 - Economie/Forex

![[Orishas-finance] : ORISHAS FUNDS360 - Les données du marché africain s'offrent à vous](/uploads/news/859fd87b75b5b18da5e7104b992d6394.jpg)

15/12/2022 - Economie/Forex Indice/Marchés

22/04/2022 - Economie/Forex

22/04/2022 - Economie/Forex